For consumers, buying a product online—and having that product shipped right to their doorsteps—has become routine. Everything is taken care of after just a few taps on their smartphone screen or laptop touchpad, and the transaction is done after a few days at most. Sometimes, even within a single day.

But if you’re a seller on the many eCommerce platforms in Southeast Asia you will deal with plenty of backstage concerns that can make or break your business. And with eCommerce becoming increasingly cross-border, it would do you well to get into international shipping, too.

What you ship locally won’t always be a hit abroad. And if overseas shoppers want your products too, there is one cross-border shipping stage that can stop you in your tracks: customs clearance.

Get accustomed to customs

You must take customs clearance seriously, and for two reasons.

First, non-clearance from customs can impact your bottom line. eCommerce platforms make it easy for buyers everywhere to provide feedback to both sellers and fellow buyers. If you receive any customs-related complaints, everyone will know about it—and avoid doing business with you.

More importantly, smoothing out the entire process from purchase to fulfillment ensures speedy and trouble-free delivery to your buyers’ doorstep.

If you have done well with your previous buyers and their parcels, newcomers will expect nothing less from you. Ironing out all the kinks beforehand means you can take on more orders from overseas, and have everything go like clockwork.

The dos of customs clearance

Most of the inclusions on our task list involve due diligence and research on your behalf. So before listing any items for cross-border purchase, make sure these items are on your to-do list.

Check if any of your products fall under prohibited lists

Some products and components are banned from international shipping without exceptions.

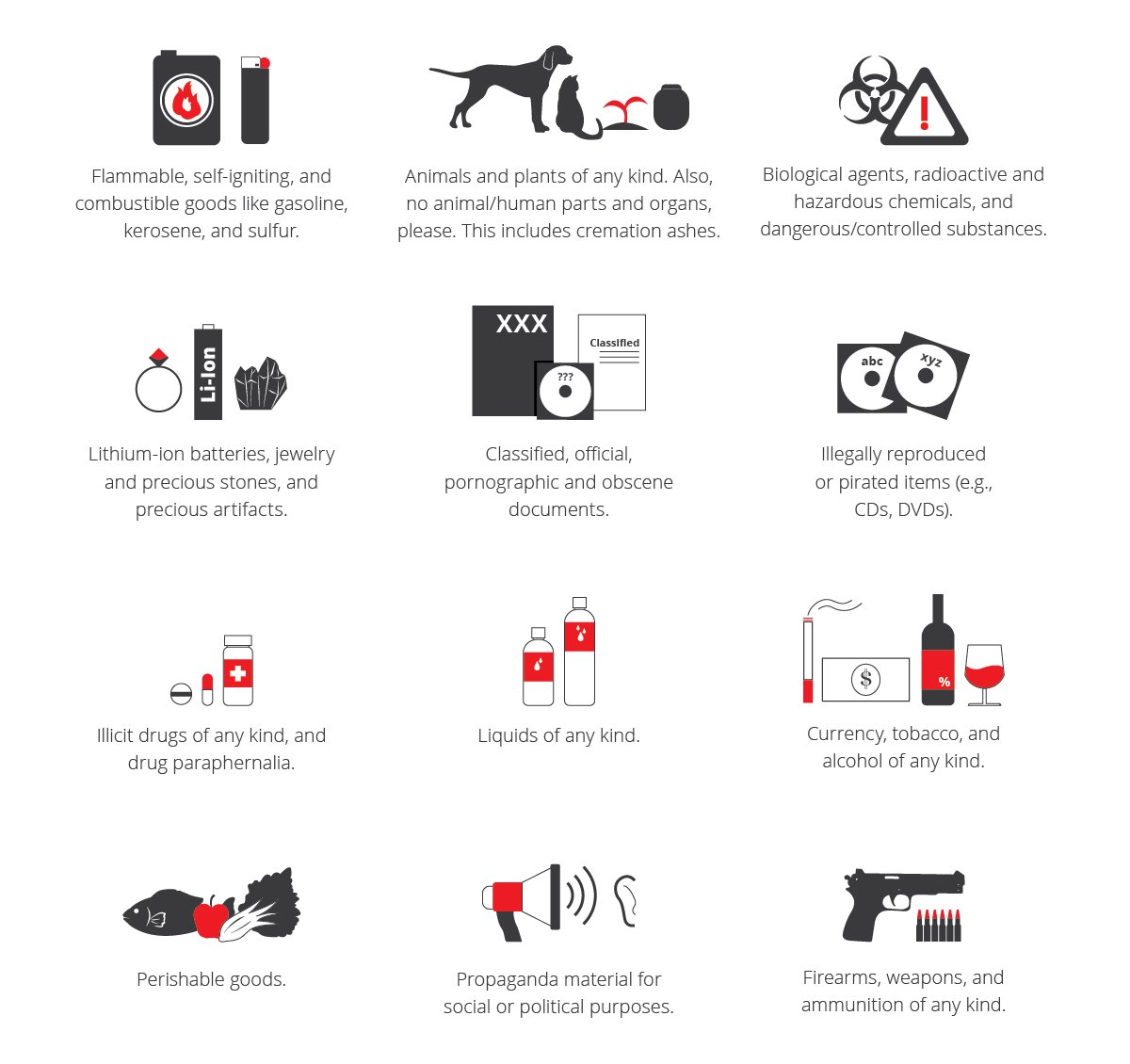

No eCommerce seller can send over through cross-border shipping:

- Flammable, self-igniting, and combustible goods like gasoline, kerosene, and sulfur. If you use it to light something up or if it’s known to light up under pressurized conditions, you can be sure it’s banned.

- Biological agents, radioactive and hazardous chemicals, and dangerous/controlled substances.

- Firearms, weapons, and ammunition of any kind.

- Liquids of any kind.

- Illicit drugs of any kind, and drug paraphernalia.

- Currency, tobacco, and alcohol of any kind.

- Animals and plants of any kind. Also, no animal/human parts and organs, please. This includes cremation ashes.

- Classified, official, pornographic and obscene documents.

- Propaganda material for social or political purposes.

- Perishable goods.

- Illegally reproduced or pirated items (e.g., CDs, DVDs).

- Lithium-ion batteries, jewelry and precious stones, and precious artifacts.

We suggest you contact your chosen shipping service regarding all the inclusions on your destination countries’ prohibited lists. Some lists may be more thorough than others, and it never hurts to ask questions and check for yourself.

Most shipping services also make their lists available online. Our Malaysia, Philippines, Indonesia, Vietnam, and Thailand outposts have posted their lists on their respective country websites.

Know about basic international shipping and customs rules

The next task is to learn about taxes and duties.

One of the topics you need to read up on (and look up per country) is the de minimis threshold. When you ship an item out, you need to declare its financial value. This value is then used by customs to determine how much tax will be paid to get said item into their country, and clear it for shipping.

If it is valued above the de minimis threshold, more fees will be paid—and sometimes, those fees could have the same value as the product you’re shipping. If it’s below the threshold, little to no tax will be paid, and it’s good to go on to its destination.

Monitor news alerts and latest developments

Occasionally, governments will implement additions or changes to existing laws on shipping regulations and customs duty, and enact new procedures. One of the most recent examples is the Indonesian government’s plan to begin regulating cross-border eCommerce

Do keep an eye out for these changes so you won’t be surprised and scramble to comply—or have to deal with negative impacts on your upcoming order fulfillments.

Decide who pays for additional taxes

Taxes and duties on international shipments can be handled in two ways. The seller shoulders the costs, or the seller passes them on to the buyer. Decide who will carry the added expense early in the process so you can give your buyers the correct prices or estimates.

If you are forwarding these taxes and duties to your buyer, make sure they fully know about this before they purchase from you! If they are suddenly asked to spend more and they don’t want to, they can reject your parcel.

After that, you will either have to ship the parcel back to you, or let customs destroy it. Either way, these two consequences will come at a literal cost to you.

Get the “little things” right

That’s because those so-called little things are actually the most important ones! This applies to the following concerns:

- Product declaration: Be as concise as possible. Include all product ingredients in your customs declaration, especially if you’re shipping out health and beauty supplements. Some ingredients may not be cleared by governments for general use.

- Air waybill: Place it securely on the front parcel so it can be tracked properly from start to finish.

- Waybill details: Speaking of the waybill, double-check every detail! Review each letter and number for both your shipping details and your receiver’s address. Sending your parcel all the way overseas would be for nothing otherwise!

Secure your parcels before shipping

The customs folks are there to check if (and by how much) your products can reach your buyers. They’re not there to help you out with securing your packages—or worse, repacking them.

Your shipping service will also take care of securing your parcels, but it is ultimately your responsibility to ensure your products are safe and fixed within their packaging.

Use sturdy material that can withstand rough travel and handling, and don’t let the products move around in their boxes. Close every container tightly so nothing spills or drops out en route. And don’t forget to check if everything is free of breaks, cuts, or creases before turning over to your shipping service!

Schedule your shipments accordingly

Aside from timing all your shipments to a specific country and processing them in bulk to minimize costs, remember that each Southeast Asian country has its own national and religious holiday schedules. There are also no deliveries done on Sundays.

Factor in these non-working days ahead of time, and plan for them accordingly. Give yourself (and your preferred shipping service) enough time to process your parcels and get them through customs clearance—and to your buyers—within the agreed time frame. That way, there won’t be any delays or complaints at any stage of fulfillment.

Research the shipping companies you can use, and what they can do for you

No two shipping services are the same, and no shipping job is ever routine.

Choose a company with friendly bulk-shipping rates, tracing and tracking features, and other automated or in-house services like tariff checks and customs clearance. All of these services will make life easier for you and your eCommerce buyers.

What about the dreaded don’ts of customs clearance?

Consider the warnings below the mortal sins of international eCommerce. Not only would these spell trouble for you and your business, but they could also lead to more serious complications.

Don’t sell and ship dubious items

We know the word “dubious” covers many things in life. But we’ll give you a good rule of thumb.

If a product is not approved by a regulatory agency (public or governmental), if it comes with doubtful claims (for example, it makes you lose weight quickly, whitens skin in just X number of weeks, gives you the fountain of youth in a bottle), or if it is outright deemed illegal in your destination country, don’t sell and ship it!

No product is worth the possible reputational, financial, and legal risks.

Don’t make intentional mistakes in your declarations

Some eCommerce sellers place incorrect values and descriptions in their customs declaration forms to cut both time and costs.

That’s an extremely dishonest practice. Please don’t be like them!

Tell your shipping service and/or customs exactly what you’re shipping. No matter what anyone would have you believe, honesty is always the best policy.

Don’t be sloppy in labelling, packaging, and presentation

We mentioned earlier that proper labelling and packaging are crucial in shipping eCommerce products.

Besides guaranteeing that your parcels will get to their recipients in excellent condition (and pass through customs without a hitch), there is one more reason why attention must be paid to overall product presentation.

First impressions do last. In eCommerce, sales and marketing won’t matter if your buyers are disappointed with what they see in real life. They will remember how you boxed and wrapped your product, what kind of materials you used, what they saw during unboxing, and how they felt when they received their purchase. And again, they will tell other people about it.

eCommerce depends as much on visual appeal and tactility as it does on numbers. A bad “look” can lead to bad vibes from your current and potential buyers, especially if they like recording unboxing videos and posting them on social media.

Don’t make it (too) complicated

Buyers appreciate eCommerce sellers who pack their shipments efficiently.

No one likes eCommerce sellers who go packaging-happy with excessive tape, wrappers, fillers, and other frills. Sometimes they become so enthusiastic, their buyers have trouble freeing their purchases from sticky tape and rolls of death-grip-like bubble wrap.

These additions look small and light, but they also contribute to the parcel’s overall weight. That leads to higher costs (and maybe customs duty, not to mention added trash) for your buyers.

And if products are too tightly wrapped, you can bet customs will get suspicious!

If in doubt…

Just don’t.

(You’re welcome!)

Make your life easier

Shipping your products internationally requires you to make adjustments in what you sell, how you sell them, and how you get your products to your buyers.

It’s not enough to contract a shipping service to bring your products to the last mile. Put in as much effort in customs clearance as you do in every other aspect of your business, and you’ll have more sales opportunities overseas.

Better yet, work with a shipping service that regularly connects eCommerce sellers with buyers within the Southeast Asian region! J&T Express is open for business in Singapore, Malaysia, the Philippines, Thailand, Vietnam, and Indonesia.

Looking for a reliable partner for international delivery?

Fill up the following form to get started.